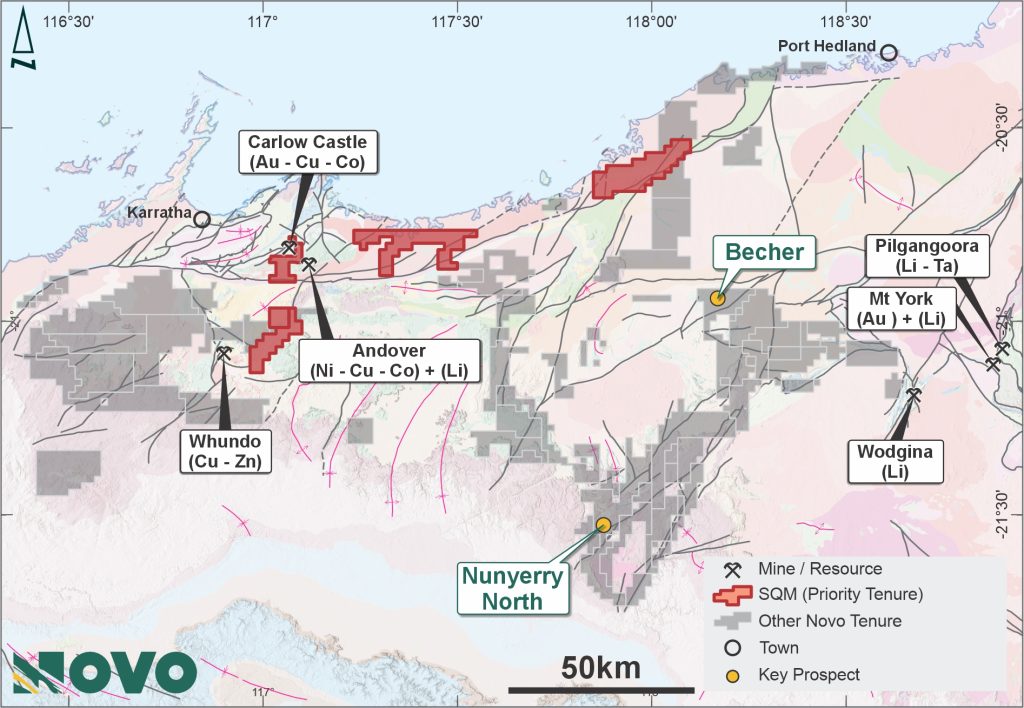

The West Pilbara Project encompasses approximately 4,300 km2 portfolio of tenements prospective for a variety of commodities and deposit styles.

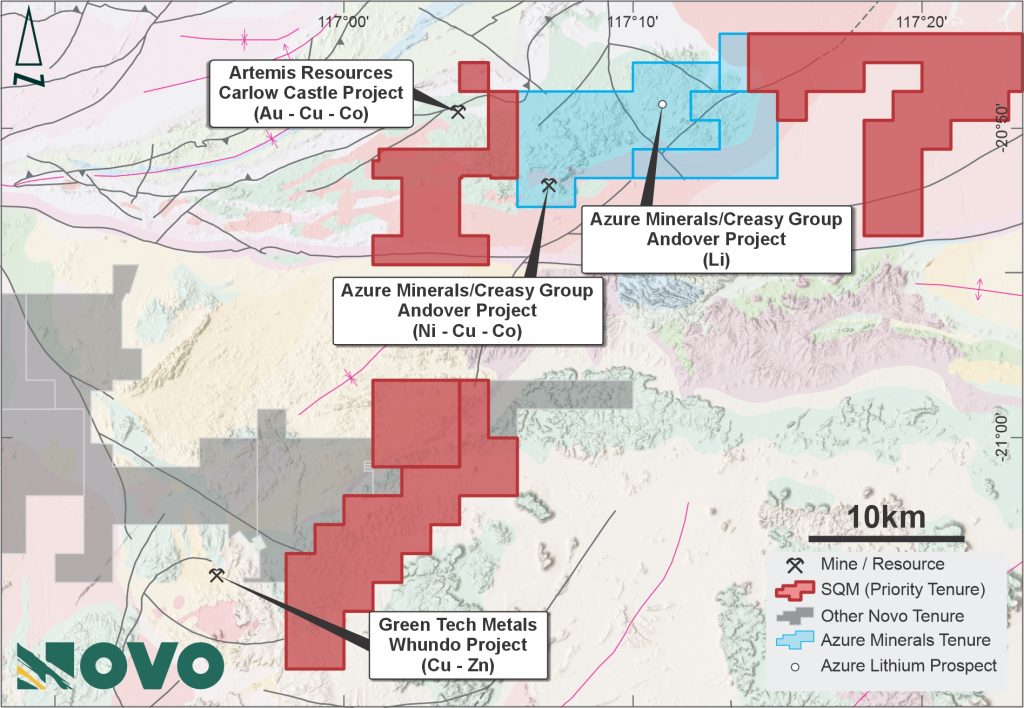

Several battery and base metal targets occur in the West Pilbara Project tenure immediately adjacent to existing deposits including Azure Minerals (ASX: AZS) Andover and Ridgeline Ni-Cu (and Li) deposits, and Artemis Resources (ASX: ARV) Carlow Castle Au-Cu-Co Project. Other resources in the vicinity are hosted in geology that extend into Novo tenements, including Radio Hill (Ni-Cu-Co) and Whundo (Cu-Zn).

In December 2023, Novo entered into a joint venture with SQM Australia Pty Ltd (SQM), a wholly owned subsidiary of global lithium producer Sociedad Química y Minera de Chile S.A., in relation to a number of Novo’s prospective lithium and nickel exploration tenements forming the Harding Battery Metals Joint Venture (HBMJV).

SQM paid Novo A$10 million for a 75% interest in the Priority Tenements and for an option over additional Pilbara exploration tenements, with Novo retaining a 25% interest, along with 100% ownership of the gold, silver, PGE, copper, lead and zinc mineral rights. Any tenements over which the option is exercised will be held by the HBMJV in the same proportions as the existing tenements (75% SQM and 25% Novo).

Novo’s 25% interest will be free carried by SQM until a decision to mine is made by the HBMJV participants. Novo will also be entitled to a contingent success payment based on the lithium contained in a JORC compliant ore reserve upon completion of a feasibility study. SQM is the manager of the HBMJV.

The HBMJV with SQM is a significant milestone for Novo, providing leverage to battery metals discoveries across a package of tenements